proposed estate tax changes october 2021

July 13 2021. Reduce the current 11700000 per person gift and estate tax exemption the unified exemption by approximately one half.

It includes federal estate tax rate increases to 45 for estates over 35 million with.

. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million. The House Ways and Means Committee released tax proposals to raise revenue on September 13 2021 which included notable changes to income tax and estate and gift tax. Bernie Sanders introduced an 18-page bill called the For the 995 Percent Act.

The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million. The Sanders bill would. The 12 million dollar per person exemption from.

The federal estate tax exemption is currently 117 million and the New York estate tax exemption is currently approximately 59 million adjusted for inflation. The bill would dramatically reduce the federal estate and gift tax exclusion from its current level of 117. The proposed change.

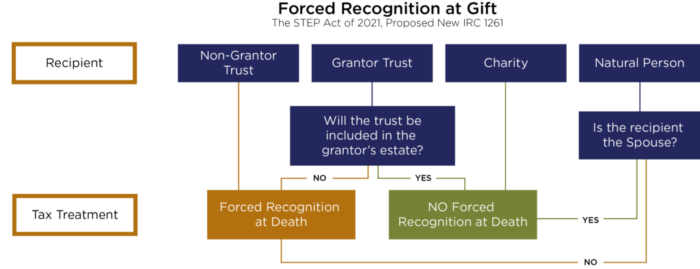

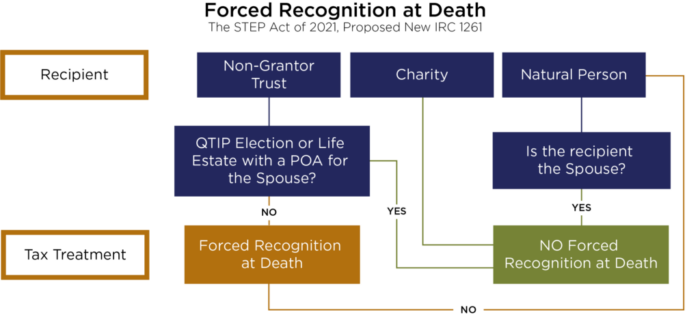

In the area of estate and gift taxation there are proposals to reduce the lifetime exemption for transfers by gift or death. Raising the top capital gains rate for households with more than 1 million. The individual tax rate could just from 37 to 396 for those making more than 400000 annually.

The exemption equivalent was significantly raised. That is only four years away and. However these are simply proposals.

This proposal if enacted will. Current federal estate tax law states that estates which exceed the exemption are subject to tax at the flat rate of 40. Here is a list of some of the proposed changes with tips on planning for them.

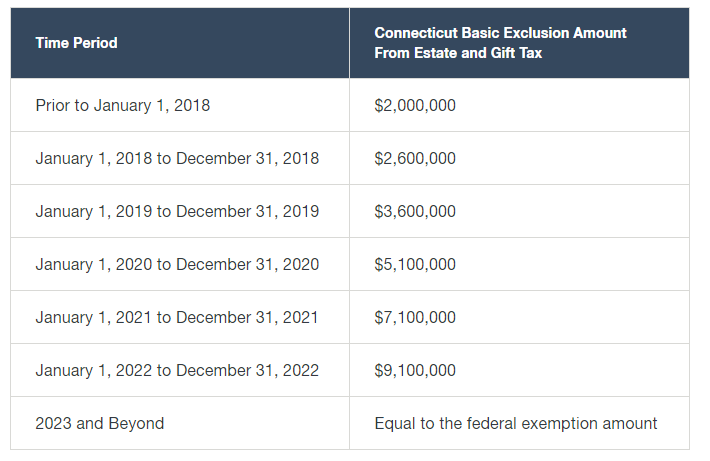

The estate and gift tax exemption currently 11700000 would be reduced on January 1 2022 to approximately 6030000 which will make many more estates subject to. But it wouldnt be a surprise if the estate tax. The Biden Administration has proposed significant changes to the.

Reduction in Estate and Gift Tax Exclusion. The current 2021 gift and estate tax exemption is 117 million for each US. If enacted into law the new estate and gift tax exemptions and rates would apply to estates of decedents dying and gifts made after 31 December 2021.

The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million. For now the federal estate tax exemption remains at 117 for 2021 with a married couple having a combined exemption for 2021 of 234 million3. For example a 20 million estate with have an estate tax.

Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11 million to 5 million adjusted for inflation. The House Ways and Means Committee released tax proposals to raise revenue on September 13 2021 which included notable changes to income tax and estate and gift tax.

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

Estate Tax Current Law 2026 Biden Tax Proposal

Biden Estate Tax 61 Percent Tax On Wealth Tax Foundation

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Estate Tax Gift Tax Learn More About Estate And Gift Taxes

Summary Of Fy 2022 Tax Proposals By The Biden Administration

Will It Or Wont It Newest Reconciliation Bill Lacks Major Estate Tax Law Changes

How Many People Pay The Estate Tax Tax Policy Center

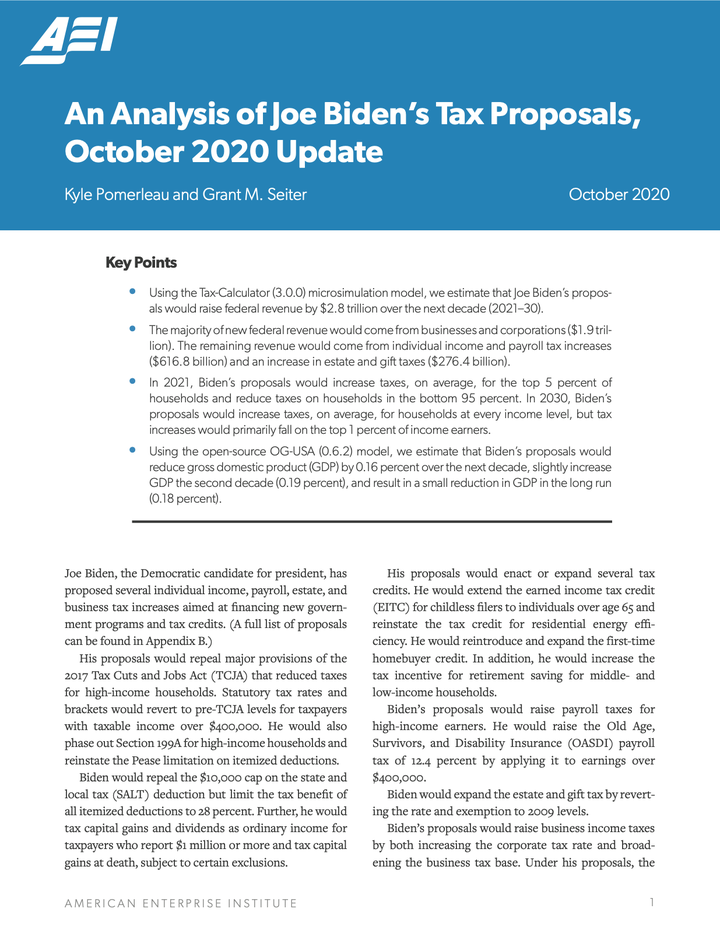

An Analysis Of Joe Biden S Tax Proposals October 2020 Update Grant M Seiter

A Guide To Estate Taxes Mass Gov

Irs Here Are The New Income Tax Brackets For 2023

Estate Tax Current Law 2026 Biden Tax Proposal

Personal Planning Strategies Lexology

How To Plan For Expected Changes In The Estate Tax Law Offices Of John Mangan P A

Estate Tax Gift Tax Learn More About Estate And Gift Taxes

Proposed Changes To Estate Taxes Threaten Farmers And Ranchers Morning Ag Clips